The country's insurance sector is suffering from a major crisis of confidence due to irregularities and corruption. Very few people are

getting insurance through insurance companies doing business in the country. A little over one and a half crore people are covered by

insurance through insurance companies. Despite the common people's mistrust of insurance companies, more than four crore people are

covered by alternative means. Microcredit institutions have brought them under insurance.The Microcredit Regulatory Authority (MRA)

certified microfinance institution has been providing a nationally diversified service for years by providing credit and savings services

as well as customer welfare funds. According to the Insurance Act, such insurance services of microfinance institutions are illegal.

Because according to the Insurance Act, no one can carry out any activity related to insurance business without obtaining a registration

certificate from the Insurance Development and Regulatory Authority (IDRA).According to the Microcredit Regulatory Authority, registered

microcredit institutions are providing various financial services including microcredit and savings services to more than four crore

unbanked marginalized people. This includes insurance services. This insurance service is - In case of death of the customer or an earning

member of the customer's family or loss of performance due to serious injury due to an accident, the customer is covered from the

'Customer Welfare Fund' for three years.Coordinating with the Customer Welfare Fund by giving financial assistance of Rs.

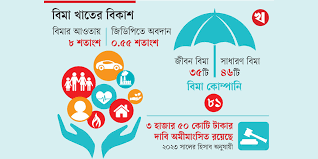

Although microcredit institutions provide insurance services to more than four crore people, according to the information of IDRA,

the regulatory body of the insurance sector, 1 crore 71 lakh 10 thousand people are currently covered by insurance through the

insurance companies doing business in the country. That is, the number of people covered by insurance through insurance companies,

more than twice as many people are getting insurance benefits from microcredit institutions.Insurance industry insiders say that large

number of people are covered by alternative or illegal insurance, which is very bad news for the insurance industry. On the one hand,

the market of the insurance companies is being destroyed, and on the other hand, a large number of people are being deprived of real

insurance services.However, they admitted that there is an image crisis in the country's insurance sector. Some companies have harassed

customers by not paying their claims properly. This has created a crisis of people's confidence in insurance. Due to which it is not

possible to bring a large number of people of the country under insurance.As there is no opportunity to conduct insurance business

without obtaining the registration certificate from IDRA, the Microcredit Regulatory Authority has demanded to recognize the 'Customer

Welfare Fund' of microcredit institutions as 'Micro Insurance'. The regulatory body has also made a written request to IDRA in this

regard. A letter in this regard was sent to IDRA on February 8 of this year.According to the MRA, according to the Microcredit

Regulatory Authority Act 2006, it is illegal for NGOs or private institutions to conduct microcredit activities without an MRA

certificate. The microfinance institutions certified by the Authority have already been providing insurance/insurance-like services

to customers along with credit and savings services as their core activities. At present, there are 738 MRA-certified microfinance

institutions with 24,000 branch offices across the country and 2,700,000 employees.Section 24(2)(h) of the Microcredit Regulatory

Authority Act 2006 on providing insurance services states, 'Providing different types of insurance services and other social development

oriented credit support for borrowers and their family members.'

MRA says, with the approval of IDRA and MRA, piloting activities are conducted to provide micro insurance services to micro credit

institutions through agency with insurance companies under various conditions. The piloting did not have the desired success.Even the

marginal customer has been deprived of coverage after the death of the customer even with a premium due to failure to save the required

data.MRA also said that due to lack of data, no members are getting insurance services and no members are getting insurance services.

This erodes customer confidence in microfinance institutions and adversely affects credit operations. Again, even if the member dies

naturally at home, a doctor's death certificate is required to get the insurance benefits, which is difficult for marginalized people.

According to the data of this regulatory body of microcredit institutions, arrears continue to increase due to non-availability of

insurance benefits even six months after the death of the member. The entire amount of the premium was supposed to be used for the

micro-credit program but it was not used. Members above 65 years of age are not eligible for insurance coverage.According to MRA, the

money from customer welfare fund is not considered as income of the microfinance institution and the money is invested in credit, which

is

playing an important role in poverty alleviation as well as keeping the wheels of the economy moving at the marginal level.

Microfinance institutions

have long been providing such microinsurance services to their customers through the formation of customer welfare funds regulated

under the MRA Act.According to the Microfinance Institutions Regulatory Agency, such microinsurance services have long been operated

on the basis of mutual trust between the customer and the microfinance institution, which is time-consuming to establish through agency

with the insurance company. Rather, by recognizing the customer welfare fund managed by microcredit institutions as a insurance service,

it will be possible to exceed the government's insurance service expansion (coverage) target and implement the action plan related to

insurance policies.The chief executive officer of an insurance company, who did not disclose his name, said that the services provided

by the microfinance institutions to the customers are illegal. Because according to the Insurance Act, no one can do insurance business

without obtaining the registration certificate from the authority. No microfinance institution has taken insurance registration from

IDRA.He said, it is true that there is an image crisis in the insurance sector. It is also true that some companies are harassing

customers. Still insurance business should be through insurance company. Strict monitoring by the regulatory body is required to ensure

that the customers get the insurance claims properly and on time. Instead of doing that, introducing micro insurance through micro

credit institutions outside the insurance company will cause serious damage to the insurance sector.CEO of Zenith Islami Life and Joint

General Secretary of Bangladesh Insurance Forum SM Nuruzzaman said, "Insurance Act says - no one can conduct insurance business without

the registration certificate of IDRA." Therefore, it is not valid for microfinance institutions to provide insurance facilities to their

customers outside the insurance company.